Universal Platform

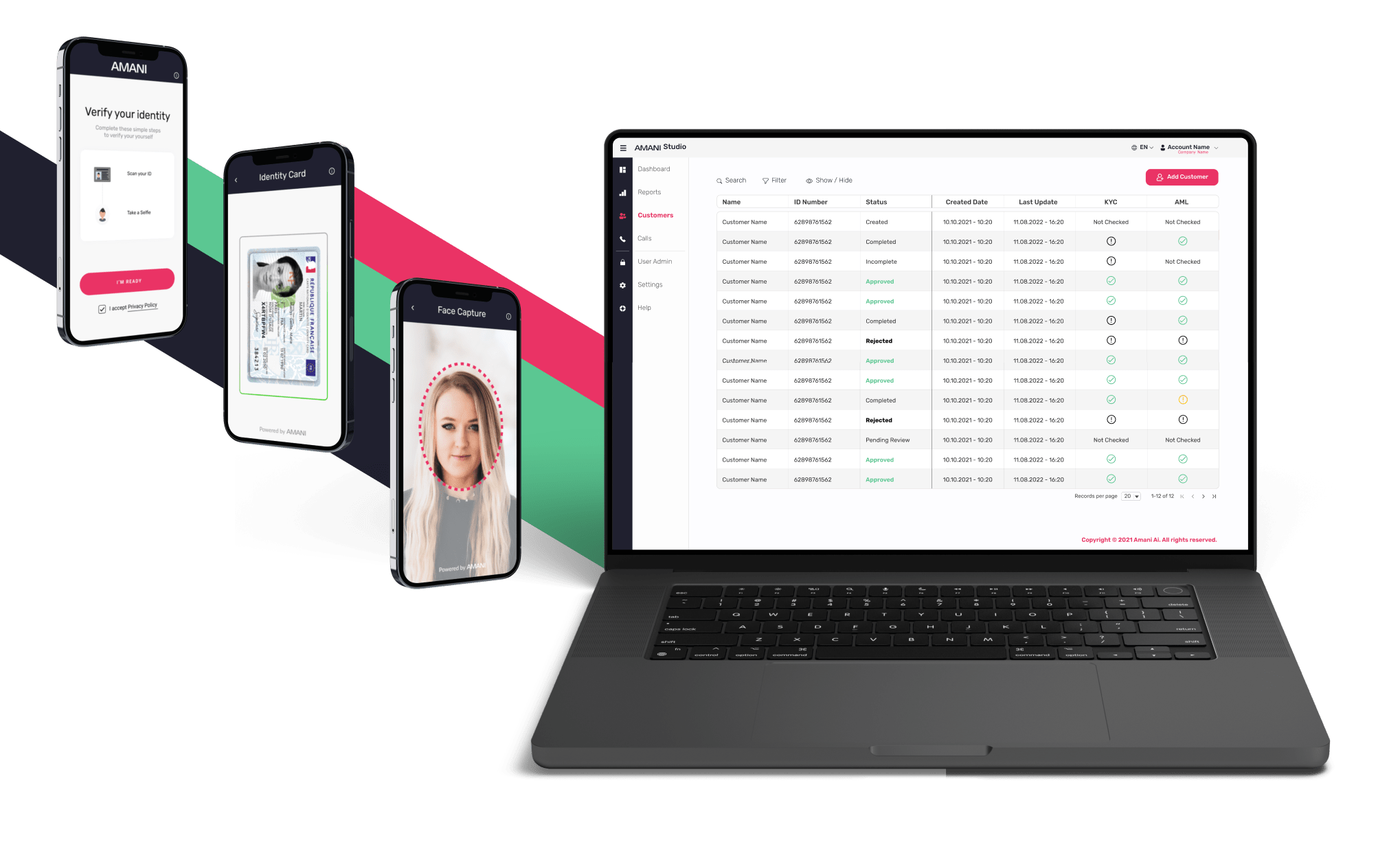

Intelligent journeys that prevent Identity Fraud

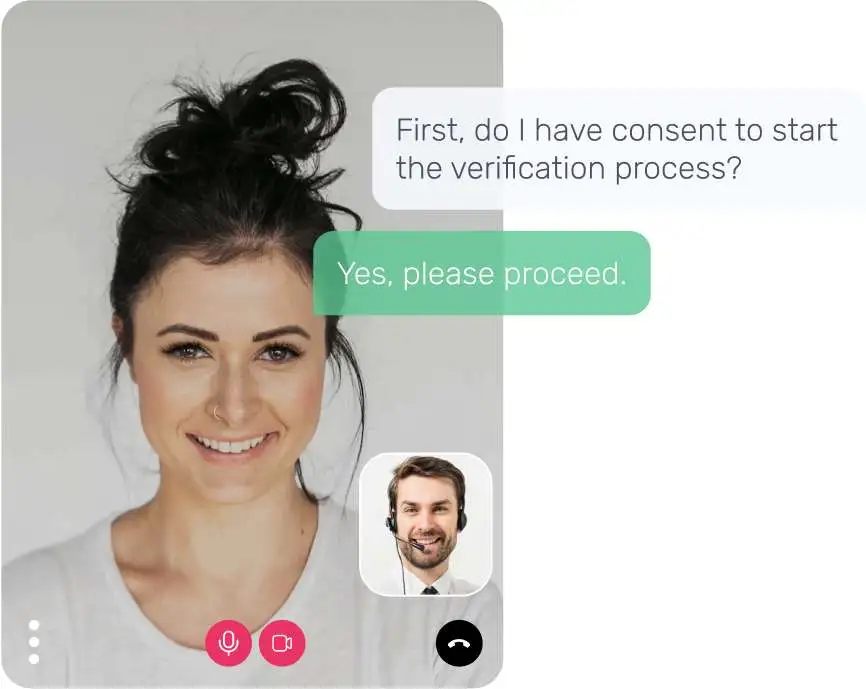

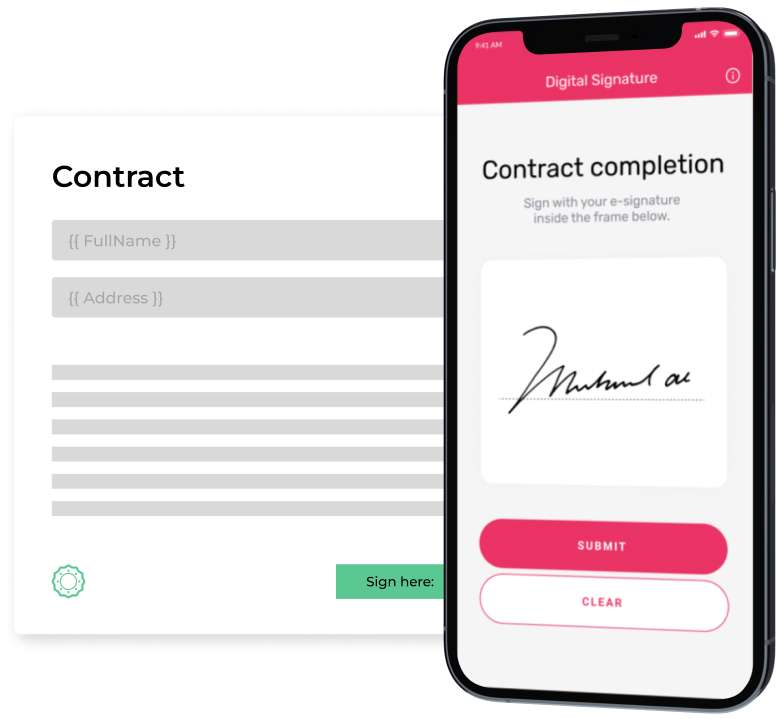

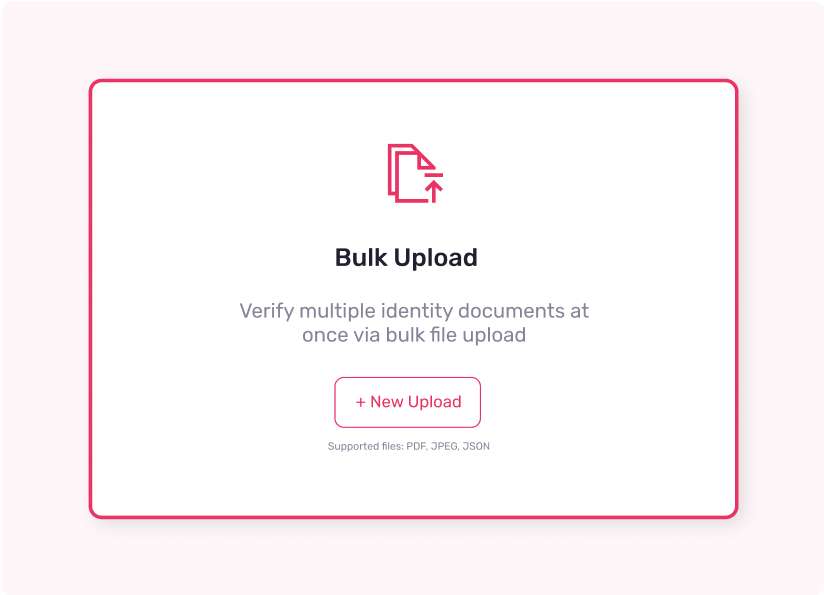

A comprehensive suite of customisable tools to streamline your onboarding process for identity verification, age verification, KYC & AML compliance, video onboarding, biometric login, right to work and rent checks, driver verification, employee verification, seller verification, delivery verification, and biometric protection for high risk transactions.

Our Technology

Key building blocks that personalize your journey

Awards

The most innovative, 100% proprietary, identity verification and biometrics solution

Certificates

International compliance authorities certificates

Why Amani?

We proudly support businesses like yours to customise your onboarding journeys, reduce fraud and meet regulatory obligations.

More Customers

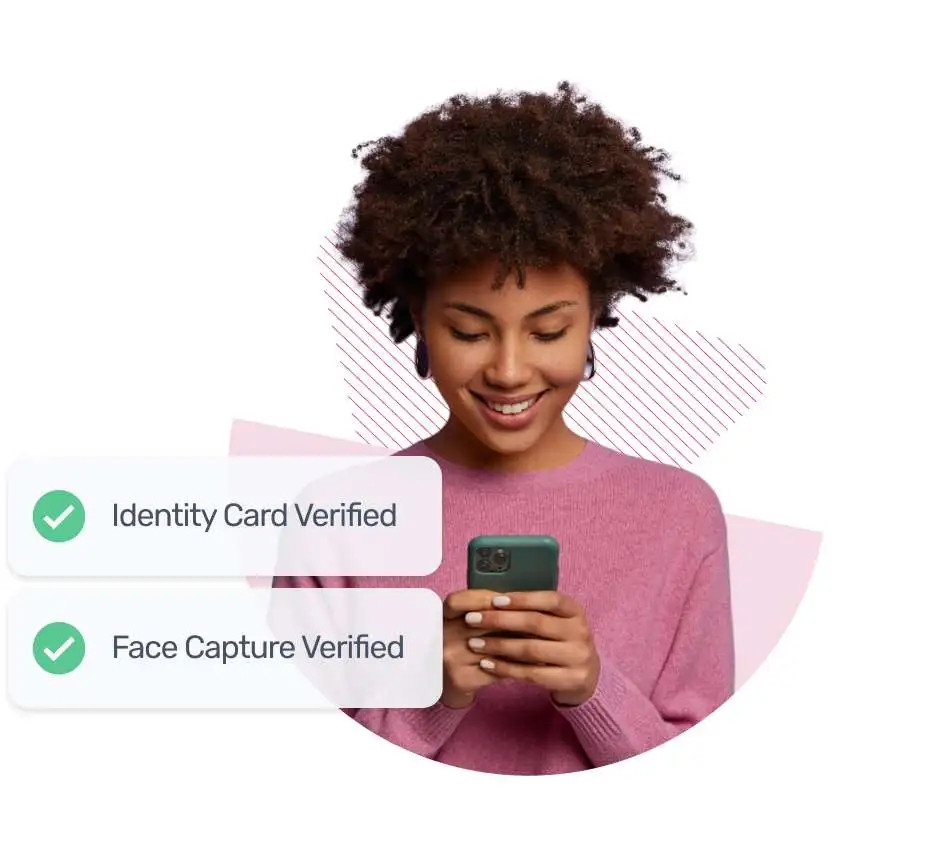

Use our Smart Capture SDK to onboard more customers and make a great first impression with 100% automation.

Fight Fraud

Prevent identity fraud with our award-winning verification and biometrics tools & fraud detection engines.

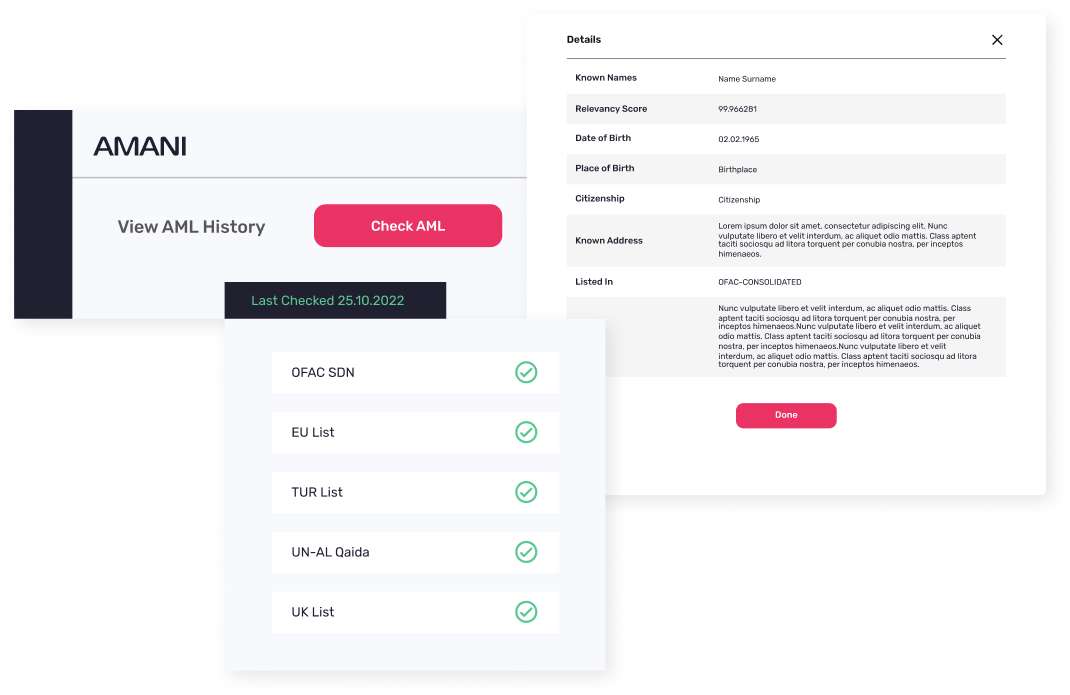

Maximize Compliance

Ensure compliance with global and local regulations, including KYC, AML, and age verification requirements.

Reduce Costs

Significantly reduce costs by fully automating the Know Your Customer & Anti Money Laundering process.

Our Performance

Our technology completely eliminates bias & maximises conversion rates

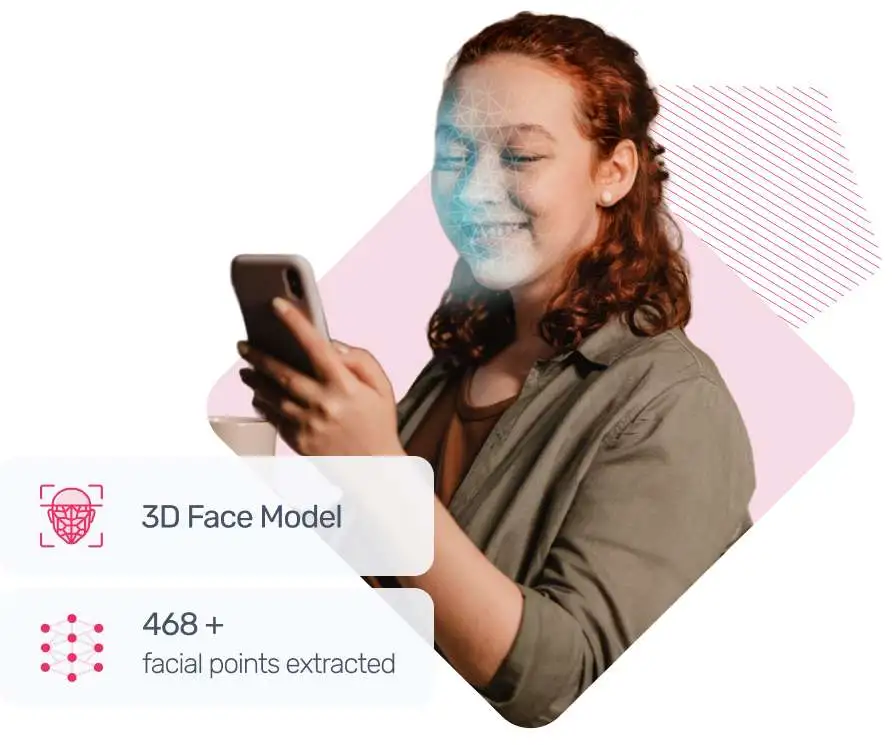

The Amani Modules are built in-house by our team of highly experienced AI and Computer Vision Engineers using proprietary AI Models and Engines. We adapt quickly to the changing nature of identity and biometric fraud to deliver the most accurate, customisable, secure, and innovative IDV & Biometrics Technology available in the market.

1/8,000,000

face liveness FMR at a success rate of 98.8%

99.8%

fraud detection accuracy

<5 seconds

document processing time

24 hours

to support a new document

Designed for developers

Integrate the most powerful and easy-to-use APIs & SDKs

Integrate in 15 minutes with our API & SDK options or 5 minutes with our low code, no integration option. We can deploy on any cloud or on-premise giving you access to all geographies.

Detailed Documentation

Product Guides

API Libraries

Multi-platform support

Ready to get started?

Explore Amani Ai, or create an account instantly and start verifying. You can also contact us to design a custom package for your business.

Always know what you pay

Integrated per-transaction pricing with no hidden fees.

Start your integration

Get up and running with Amani in as little as 1 hour.