The UAE Financial Intelligence Unit reported over 320,000 suspicious transaction reports in 2023, double the figure from the previous year (UAE FIU Annual Report). While this is a sign of tighter controls, it also points to a growing problem, which is overwhelmed compliance teams and increased operational friction.

For compliance officers across the Gulf, especially in the UAE and Saudi Arabia, 2025 brings new urgency. While a shortage of skilled AML staff leaves institutions exposed to potential threats, high false-positive rates slow operations and frustrate customers.

If you are a compliance officer looking for a reliable solution for the modern compliance challenges, this blog can help. Here, explore how AML compliance software in Dubai and across the Gulf is evolving, what new regulations are shaping the future, and how RegTech solutions can help ease the pressure. So, without delay, let’s start!

Regulatory Changes Shaping AML in the Gulf- Stronger Rules for Key Sectors

In the UAE, new directives introduced in 2024 expanded AML responsibilities for sectors such as real estate, precious metals, and virtual assets. These changes require enhanced due diligence, transaction monitoring, and accurate reporting. Click here for a detailed insight.

On February 5, 2025, SAMA launched its Fintech Regulatory Sandbox to enable innovators to test new financial technologies under supervision for boosting fintech innovation and ensuring AML controls in experimental environments.

What This Means for Compliance Teams

These new requirements demand faster, smarter, and more integrated approaches to KYC and AML compliance. Manual reviews and legacy systems are no longer enough.

With growing transaction volumes and stricter reporting rules, financial institutions need tools that reduce workload, improve decision-making, and support real-time risk assessments.

Key Risks for AML Teams in 2025

If your AML process is still based on manual reviews or disconnected tools, your team may be exposed to several risks:

- High false-positive rates slow investigations and delay customer interactions.

- Shortage of AML professionals increases the burden on current staff.

- Slow onboarding caused by outdated KYC processes leads to customer dissatisfaction.

- Regulatory penalties are increasing. In 2025, the UAE Central Bank issued a series of high-value fines against various financial entities for serious breaches of AML/CFT regulations where the total fines exceeded Dh339 Million.

- Fragmented systems create gaps in reporting, monitoring, and audit trails.

- Pressure from leadership is rising, with boards demanding performance metrics and return on compliance investments.

These issues can damage customer trust, increase compliance costs, and lead to reputational harm.

Amani Vista – Your Trusted Partner for Onboarding and Continuous AML Screening

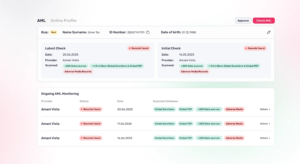

At Amani, we proudly introduce Amani Vista, a powerful solution built on our proprietary technology to support AI-driven sanctions screening, PEP checks, and adverse media monitoring.

Fully integrated within Amani Studio, this solution helps minimise compliance risks while keeping operational costs under control.

Why Opt for Amani Vista

Integrated KYC and AML compliance

The same workspace covers eKYC, document checks, sanctions screening and transaction monitoring, removing delays caused by jumping between tools.

Real-time sanctions and watchlist checks

Customer names are screened continuously against global sanctions and watchlists that update as soon as lists change, delivered through an API for straight-through processing.

Real-time sanctions and watchlist checks

Customer names are screened continuously against global sanctions and watchlists that update as soon as lists change, delivered through an API for straight-through processing.

Comprehensive PEP and adverse-media screening

Structured PEP data and live adverse-media feeds flag politically exposed or high-risk individuals early, helping teams protect the firm’s reputation.

Automated ongoing monitoring and full audit trail

Scheduled re-screening keeps risk scores current, while every action is time-stamped in Amani Studio to satisfy regulators and simplify audits.

Amani Vista is designed to streamline compliance processes while enhancing risk management. Our software is professional, reliable, and scalable, built to meet the demands of modern financial operations.

Seamless Compliance Management with Amani Studio

Amani Studio simplifies client verification and compliance with a secure, all-in-one portal designed for efficiency and control. What makes it different? This platform automates renewals, manages exceptions, sets tailored risk protocols, and integrates third-party datasets to reduce manual work while ensuring regulatory alignment.

Unlike traditional systems, Amani Studio eliminates the need for manual renewal processes. This ensures timely updates and frees teams from administrative delays. As a result, exception handling becomes faster, leading to quick issue resolution and improved client satisfaction.

The platform also excels in identity verification. It performs biometric checks, liveness detection, MRZ validation, and selfie comparisons. When needed, teams can override or correct data manually. With 99.6 percent OCR accuracy, Amani Studio ensures reliable data integrity.

To support regulatory compliance, every user action is logged with a full audit trail. AML history is easy to access, while device and location verification confirm user authenticity across regions.

Additionally, businesses can export customer profile data as PDF files for reporting or internal use. By combining automation with manual oversight, the Amani Studio compliance platform helps organizations stay audit-ready, efficient, and secure.

Action Plan: 5 Steps to Improve Your AML Setup This Week

If you’re a compliance lead looking to boost efficiency and reduce risk, start with these steps:

1. Evaluate Your Current AML Workflow

Measure alert volumes, false-positive rates, and investigation timelines. Identify where time is being lost.

2. Identify Risk and Performance Gaps

Check whether your current systems handle all required KYC and AML tasks. List gaps that create delays or errors.

3. Test a RegTech Sandbox

Use past data in a RegTech test environment to compare performance against your current system. Look for improvements in accuracy and alert handling speed.

4. Train Staff on Smart Compliance Tools

Schedule weekly sessions to help your team understand how to use new features like AI explanations, automated reports, and smart dashboards.

5. Set Monthly Compliance Goals

Define KPIs such as false alert reduction, faster STR filing, or reduced onboarding time. Use reports and dashboards to track performance.

Final Thoughts: Turn Compliance Into Your Strength with Amani

In 2025, compliance officers in the Gulf face a changing landscape. Regulations are tighter, customer expectations are higher, and skilled AML staff are hard to find. But Amani Vista can shift compliance from a challenge to a competitive advantage.

AML compliance software is no longer optional for the BFSI sector. It’s essential for reducing errors, improving customer trust, and staying ahead of regulatory pressure.

Ready to modernise your AML process with Amani Vista? Book a free demo and explore how our innovative KYC and AML compliance software for the UAE BFSI sector can support your goals.

Frequently Asked Questions

1. How does Amani help reduce false-positive rates in AML alerting?

Amani uses AI-powered risk scoring and behavioural pattern analysis to triage alerts by severity. This approach helps compliance teams prioritise high-risk cases, reducing false positives by up to 40% and improving overall case-handling efficiency.

2. Can Amani’s platform integrate with our existing core banking or compliance systems?

Yes, Amani’s KYC and AML compliance software offers flexible APIs that support integration with core banking platforms, CRM tools, and other compliance systems. Our technical team works closely with your IT staff to ensure smooth implementation and minimal disruption.

3. Does Amani support local regulatory requirements in the UAE and Saudi Arabia?

Absolutely. Amani’s platform is regularly updated to reflect changes in Gulf AML laws, including requirements from the UAE Central Bank, the Ministry of Economy, and SAMA. We also support FATF-aligned frameworks and region-specific STR reporting formats.

4. How does Amani support compliance teams with limited in-house AML expertise?

Amani’s intuitive interface, automated STR generation, and explainable AI features allow junior staff to handle cases confidently. Our platform reduces manual workload and gives smaller teams the tools they need to scale effectively.

5. What onboarding and support services does Amani provide?

We offer comprehensive onboarding, including product training, system configuration, and sandbox testing. Our support team is available to assist with compliance queries, custom rule setups, and ongoing performance optimisation.