A formal UK standard for AI audits is launching to bring structure to an increasingly complex compliance landscape. Across global markets, regulators are paying closer attention to how AI is used to make decisions in customer verification, risk scoring, and fraud detection.

Today compliance officers are under mounting pressure. Rule changes are constant across FATF, FCA, MAS, and other bodies. Manual reviews pile up, slowing down decision-making and leaving room for costly human error. False positives frustrate legitimate customers.

This blog explores how AI agents are transforming compliance workflows and handling complex tasks, from document checks to audit logging and helping teams stay compliant, efficient, and audit-ready.

Global Shifts in AI Compliance One Can’t Ignore

Several recent developments signal a new regulatory and operational environment for compliance professionals:

- The UK is introducing a standardised audit framework for AI systems to ensure fairness, reliability, and transparency in decision-making processes. This new rule requires financial institutions to demonstrate how AI tools reach decisions, especially in regulated tasks like identity verification and risk scoring.

- Major financial centres in the GCC have proposed updates to the regulatory sandbox to accelerate the controlled deployment of AI agents in compliance and governance processes. This opens doors for faster adoption but demands a stronger proof of auditability from vendors.

- The central bank in Singapore has released updated guidance on the use of artificial intelligence in financial services. The focus is on accountability, model validation, and the right to explanation in customer-facing decisions.

- Across Europe, regulators are starting to question the unchecked spread of generative AI in financial firms. There is growing pressure for explainable AI and traceable decision logs.

These shifts affect compliance teams globally. It is no longer enough to use AI in isolated areas of the compliance process. Institutions must now prove the integrity of their entire decision-making pipeline. The expectation is not just automation, but responsible, monitored automation.

What’s at Stake If You Don’t Automate Smartly

Organisations that fail to adapt to AI-powered, end-to-end AML compliance software face growing risks:

- Regulatory penalties for failing to meet audit or transparency standards

- Increasing operational bottlenecks due to manual KYC and AML reviews

- Customer dissatisfaction from long onboarding times and false positive rejections

- Mounting internal costs as compliance teams scale with headcount rather than automation

- Loss of competitive edge to firms that adopt smart AI agents to streamline compliance

- Reputational damage from public scrutiny around biased or opaque AI decisions

Compliance officers are already stretched thin. Without automation that is accurate, explainable, and fully traceable, compliance becomes a reactive burden rather than a strategic function.

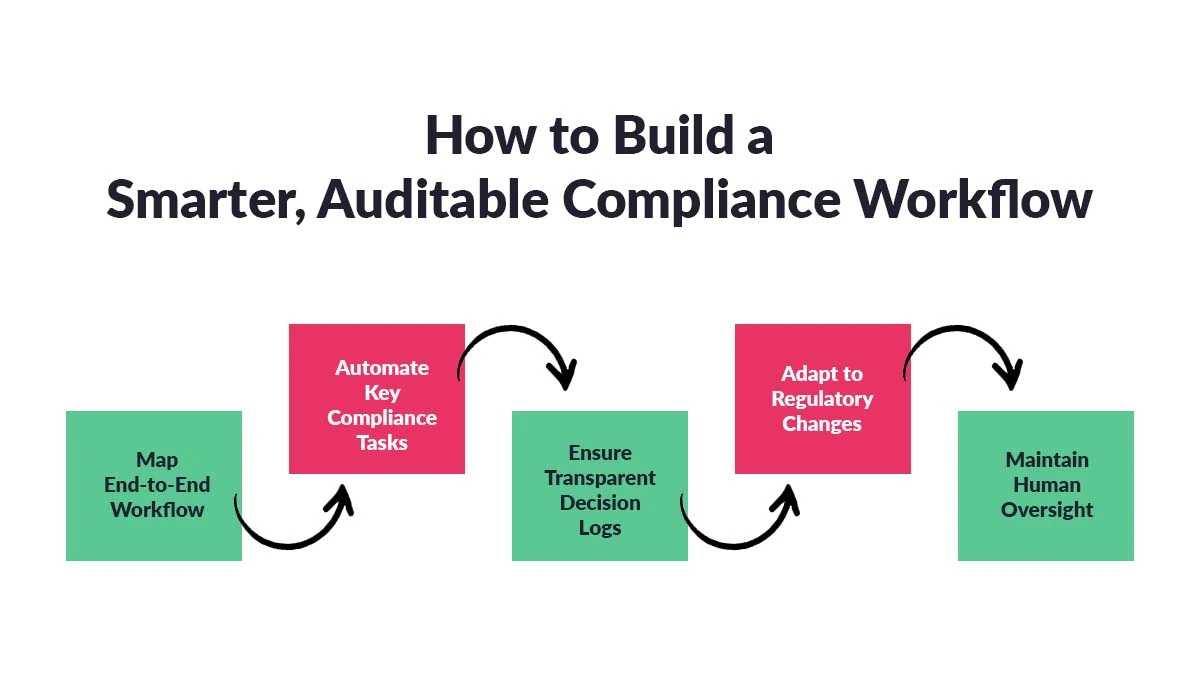

How to Build a Smarter, Auditable Compliance Workflow

At Amani, we believe that AI agents should do more than automate single tasks. They should work across the entire compliance journey, from onboarding to continuous monitoring, while leaving behind a clear and auditable trail.

Here’s how organisations can respond effectively:

- Map your compliance workflow from end to end. Identify where repetitive decisions or slow manual reviews are creating friction or exposure.

- Implement intelligent agents that handle identity verification, sanction screening, and document analysis in one flow.

- Prioritise transparency by using systems that store decision logs, highlight uncertainties, and allow for human overrides.

- Adapt rules dynamically, with AI agents trained to adjust based on changing regulatory guidance across multiple jurisdictions.

- Build in oversight, ensuring that agents always operate with clear boundaries, permissions, and accountability.

Amani’s AML compliance software for banks is designed to support this model. Our AI agents work across entire compliance functions, combining biometric identity checks, dynamic risk scoring, and ongoing monitoring with full audit visibility. The system supports compliance officers by removing repetitive workload while ensuring nothing critical slips through.

The Amani Agent: A New Standard for Automated Compliance

Amani, the AI-driven compliance platform based in DIFC’s AI Campus, has unveiled its latest innovation, the Amani Agent, an intelligent compliance assistant engineered to automate KYC, KYB, and AML workflows across regulated industries.

Described by the team as “a new way to run compliance,” the Amani Agent tackles the repetitive, labor-intensive work that typically overwhelms compliance officers. From identity checks and source of funds verification to jurisdiction-specific rule application and real-time risk scoring, the agent performs seamlessly in the automatic generation of regulatory-ready documentation such as CDDs, SARs, and internal audit reports.

The Amani Agent also intelligently extracts and validates data from financial documents, streamlining an often time-consuming part of compliance. It goes beyond basic checks by replacing manual phase 2 compliance reviews, offering a seamless AI-powered approach that further accelerates onboarding, enhances fraud detection, and ensures institutions meet regulatory demands with minimal effort.

Currently in beta with select banks and crypto exchanges in the UAE, the Amani Agent is built to scale globally, with expansion to the UK and other jurisdictions on the horizon.

What sets the Amani Agent apart is its adaptability. It leverages Amani’s proprietary large language model(LLM), trained on five years of compliance-specific data, to stay up-to-date with evolving regulations. This allows the agent to dynamically adjust workflows, document requirements, and risk thresholds depending on the applicable geography, eliminating the need for constant manual intervention or costly consultants.

Action Checklist for Compliance Officers

To move toward a more agile and compliant workflow using AI agents, compliance leaders can take the following actions this week:

- Review your current compliance process and highlight the most time-consuming manual tasks.

- Evaluate which tasks can be handled by AI agents while maintaining oversight and transparency.

- Identify gaps in your audit trails and assess whether your current systems explain decisions clearly enough for regulators.

- Define metrics for success such as reduction in false positives, onboarding time, and review backlog.

- Select one pilot area, like sanctions screening or ID verification and begin evaluating platforms that support end-to-end agent-based automation.

- Set up a cross-functional compliance and tech team to monitor performance and risk from day one.

Automate With Confidence – Start Your Journey Today with Amani Agent

AI agents are helping compliance teams shift from reactive firefighting to proactive control. By automating end-to-end compliance functions while maintaining auditability and alignment with regulatory expectations, compliance officers can reduce risks, improve efficiency, and stay one step ahead of constant change.

Want to see how your team can benefit from agent-led compliance? Book your demo with Amani today and explore how our platform simplifies complex compliance tasks across borders and regulations.

Frequently Asked Questions by Compliance Offices Globally

- What are AI agents in compliance?

AI agents in compliance are intelligent software tools that automate decision-making tasks like KYC, AML screening, and audit logging. Amani’s AI agents help financial institutions handle end-to-end workflows with transparency, accuracy, and built-in audit trails.

- How does Amani ensure AI decisions are audit-ready?

Amani’s platform stores detailed decision logs, supports human-in-the-loop reviews, and aligns with evolving audit standards. This means compliance teams can trace every step of the process, crucial during regulator reviews or internal audits.

- Can AI agents reduce false positives in KYC checks?

Yes. Amani uses advanced machine learning and dynamic risk scoring to reduce false positives while maintaining security standards. This leads to faster onboarding and a better customer experience without compromising compliance.

- Is Amani’s platform adaptable to changing regulations?

Absolutely. Amani is built to adjust to evolving rules across jurisdictions like FATF, FCA, and MAS. AI agents update risk parameters automatically, helping your team stay compliant without constantly rewriting processes.

- Do I need developer support to use Amani’s AI agents?

No. Amani’s platform is designed for compliance teams, not just developers. It offers intuitive dashboards, drag-and-drop workflows, and ready integrations so you can deploy AI agents without deep technical skills.