In 2025, regulatory inspections surged significantly, highlighting a global push for tighter controls across non-financial sectors. Compliance managers at DNFBPs such as real estate agencies, law firms, and luxury goods dealers are facing stricter AML obligations this year. So, manual processes are no longer sustainable.

In this scenario, AI-powered AML compliance software offers a scalable, efficient solution that helps DNFBPs stay ahead of evolving regulations. This blog explores the global AML landscape and how technology can help compliance managers at DNFBPs like you respond effectively.

What’s New in the DNFBP Sector?

EU: Single AML Rulebook Now in Effect

In January 2025, the EU implemented a unified AML framework through the new Anti-Money Laundering Authority (AMLA). The rulebook introduces:

- Real-time transaction monitoring

- Enhanced due diligence for high-risk clients

- Unified sanctions and PEP screening

- Cross-border reporting obligations

The aim is consistency across member states and increased enforcement for sectors including DNFBPs.

FATF Emphasizes AI-Driven Compliance

The FATF has updated its guidance to encourage broader use of technology in AML programs. It recommends machine learning and behavioral analytics to improve risk-based approaches, reduce false positives, and create more dynamic alert systems.

Nigeria Sets Baseline AML Tech Standards

In May 2025, the Central Bank of Nigeria issued draft AML standards mandating AI-powered systems for both financial institutions and DNFBPs. Required features include automated CDD, real-time monitoring, and explainable AI outputs to support regulator transparency.

Other Key Trends

- Global focus on AI explainability in compliance workflows

- Increasing cross-border enforcement cooperation

- More scrutiny on DNFBP onboarding practices

AML Non-Compliance: What Could Go Wrong for DNFBPs in 2025

As global AML regulations continue to evolve, Designated Non-Financial Businesses and Professions (DNFBPs) are facing increased regulatory pressure. This shift brings several tangible risks that compliance managers must proactively address.

- Regulatory Penalties

With stricter enforcement across jurisdictions, DNFBPs that fail to meet AML requirements face significant fines, license suspensions, or even criminal liability. Regulators are now holding non-financial entities to the same standards as financial institutions, particularly when it comes to customer due diligence and real-time monitoring.

- Operational Burden

Manual compliance processes are time-consuming and error-prone. Reviewing documents, verifying identities, and checking against watchlists manually can delay client onboarding, create workflow bottlenecks, and divert staff from higher-value tasks.

- False Positives

Traditional rule-based systems often generate a high volume of false alerts. This overwhelms compliance teams and reduces their ability to detect genuine threats. It also increases the cost and complexity of investigations, without improving outcomes.

- Data Silos

Using separate systems for KYC, transaction monitoring, and screening makes it difficult to build a unified risk profile. Fragmented data leads to blind spots in risk assessment and inconsistent reporting.

- Reputational Harm

A compliance failure can erode client trust, damage partnerships, and attract negative media attention. In sectors like real estate or legal services, reputation is critical, making AML lapses especially costly.

By understanding these risks, DNFBPs can take strategic steps to modernize their compliance programs and stay ahead of regulatory expectations. And these challenges make it essential for DNFBPs to modernize their AML systems by implementing AML and KYC compliance software designed for the DNFBP sector in the UAE and globally.

How DNFBPs Can Stay Ahead of AML Rules- Steps to Take

Centralize Compliance Operations

Implement a single platform that manages CDD, screening, monitoring, and reporting. A unified system ensures consistency, reduces duplication, and provides a clear audit trail.

Leverage AI for Risk Detection

Machine learning can identify patterns in customer behavior and flag suspicious activity more accurately than manual methods. These models improve over time, reducing false positives and accelerating investigations.

Focus on Explainable AI

Regulators now require transparency. Choose solutions that offer explainable AI, showing how risk decisions are made and what triggered alerts.

Maintain Model Governance

Regularly test and validate AI systems for accuracy and fairness. Establish clear documentation for audits and model governance reviews.

Train Compliance Teams

Ensure teams understand how to interpret and act on AI-generated alerts. Provide hands-on training and update policies to reflect new workflows.

Amani’s AML platform supports DNFBPs with real-time risk dashboards, smart alerting, and explainable AI models—helping teams stay compliant and confident.

Apply Enhanced Due Diligence for High-Risk Clients

It is necessary for DNFBPs to conduct Enhanced Due Diligence (EDD) when dealing with clients from high-risk jurisdictions, politically exposed persons (PEPs), or complex ownership structures. EDD involves deeper investigation into the source of funds, ongoing monitoring, and senior management approval, where the right AML and KYC compliance software is required to streamline the process.

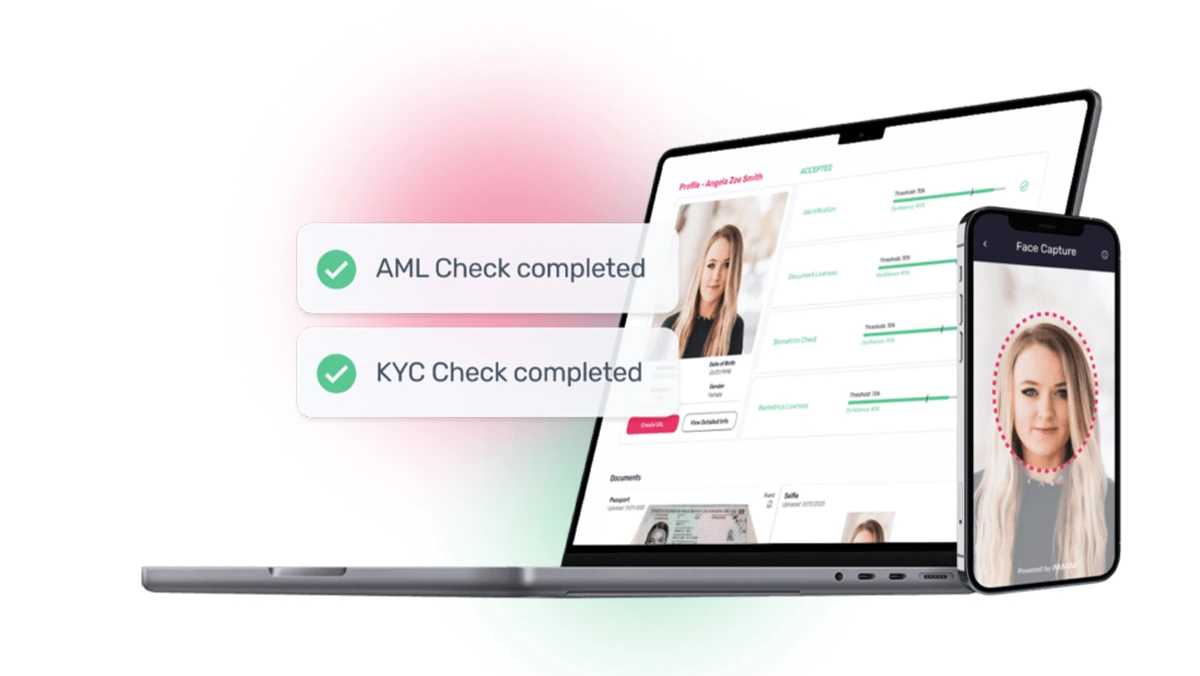

Amani Vista: Smarter Onboarding and Ongoing AML Screening

In order to help DNFBPs meet today’s compliance demands, Amani Vista offers a fully integrated AML solution that streamlines onboarding and continuous screening- all within the Amani Studio. The platform leverages AI to automate sanctions screening, PEP checks, and adverse media monitoring, reducing compliance risk while optimising operational efficiency. DNFBPs also need to verify client identities and understand the nature of their transactions before onboarding. So, our AI-driven software powered by Amani’s proprietary technology streamlines KYC through automated identity verification and seamless risk screening at the point of entry.

Here’s how Amani Vista supports your compliance workflow:

Real-Time Sanctions and Watchlists

Stay protected from financial crime and costly penalties with real-time access to continuously updated global sanctions data. Amani’s automated API integrations ensure your screening processes are fast, accurate, and always current, minimising manual workload and error.

Comprehensive PEP Screening

Effortlessly identify high-risk individuals with access to extensive, structured PEP data from global sources. Amani enables quick risk assessment and helps your team uphold compliance standards while protecting your organisation’s reputation.

Adverse Media Monitoring

Detect and evaluate reputational risks early with Amani’s intelligent adverse media screening. Every profile action is logged and timestamped, offering a complete audit trail for full regulatory transparency. Amani Studio’s secure environment ensures data integrity and compliance-ready internal monitoring.

Amani Vista brings onboarding and ongoing AML compliance into a single, intelligent interface, built to adapt as regulations evolve and your business grows.

Action Checklist for Compliance Managers

- Assess your current AML tools

Identify inefficiencies, data gaps, and manual bottlenecks in your compliance process. - Adopt an AI-enabled AML platform

Select a solution that integrates CDD, screening, monitoring, and reporting. - Integrate and unify your data

Ensure client data, alerts, and risk scores are accessible from one place. - Set up model validation

Regularly test AI models for fairness, accuracy, and explainability. - Train your team

Help staff confidently use the platform and interpret AI-driven insights. - Document everything

Maintain clear audit trails, risk scores, and model governance records.

Conclusion

2025 brings new challenges and tighter regulations for DNFBPs. Manual processes are no longer viable. AI-powered AML compliance software can help reduce false positives, accelerate onboarding, and meet global expectations with confidence.

Book a 3-month Free trial with Amani today and explore how our intelligent AML platform supports real-time compliance, centralizes operations, and keeps your team ahead of the curve.