In an era defined by rapid technological advancements, businesses are constantly seeking innovative ways to enhance customer experiences while adhering to stringent regulations. For industries with rigorous onboarding requirements, such as banking and other highly regulated sectors, the process of identity verification has been a longstanding challenge. Enter Video KYC verification – a promising solution that promises a seamless and secure onboarding experience. However, like any transformative solution, Video KYC comes with its own set of challenges.

The Call Centre Conundrum: High Costs and Customer Churn

Traditional ID verification methods often involve labor-intensive call centre infrastructure, resulting in exorbitant costs and frustratingly long waiting times for customers. This not only strains a company’s financial resources but also contributes to customer churn, as individuals seek quicker and more efficient alternatives.

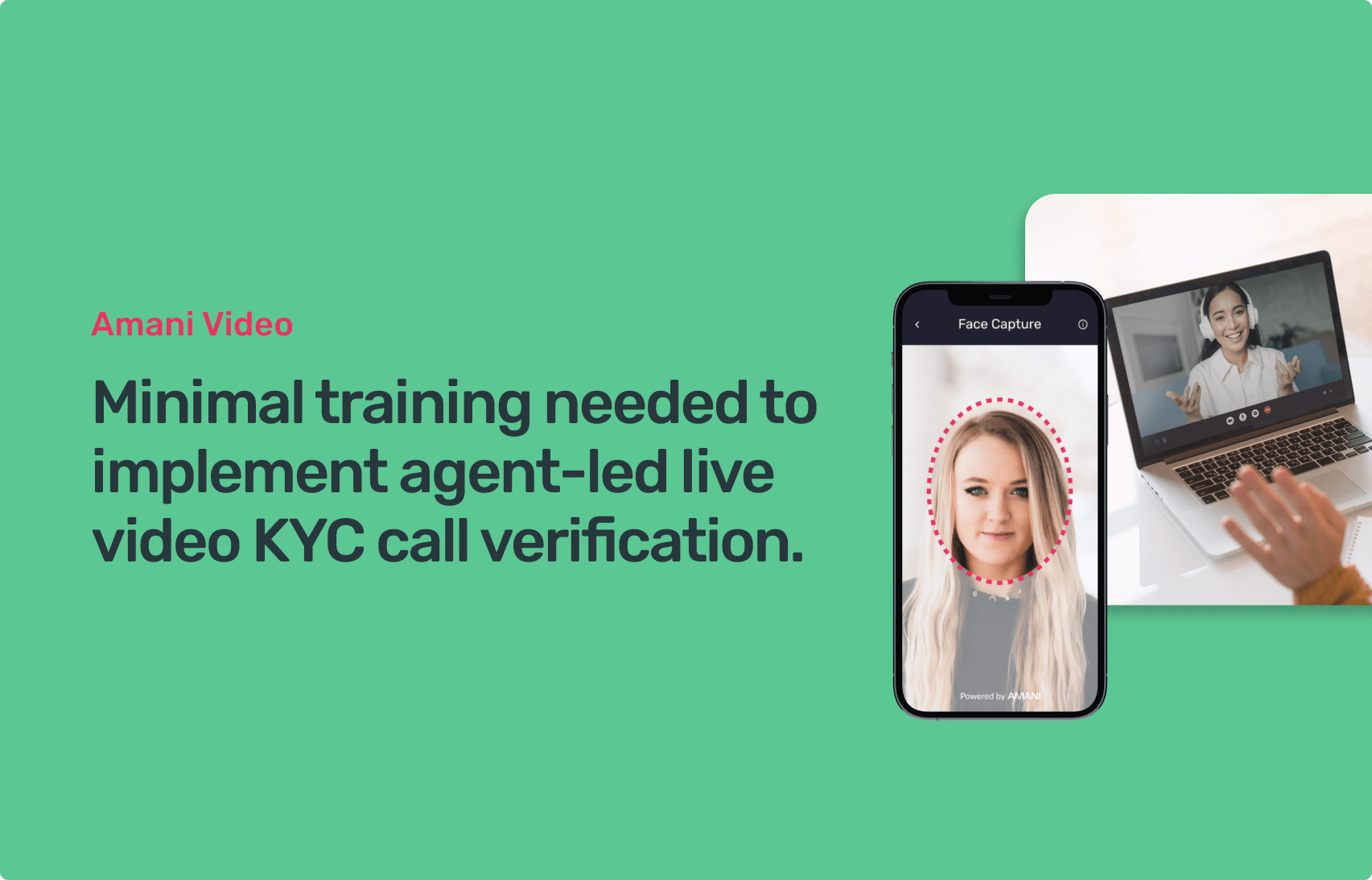

Our innovative video onboarding platform introduces a game-changing approach. By enabling swift online verification through agent-assisted video chat, we eliminate the need for lengthy call centre interactions. This not only ensures quicker onboarding but also enhances customer satisfaction, leading to higher retention rates and improved brand loyalty.

Navigating Regulatory Waters: Compliance in a Complex Landscape

For businesses operating in heavily regulated industries, compliance with industry standards and local regulations is paramount. However, the complex and ever-changing regulatory landscape often poses challenges, leading to compliance breaches and potential legal consequences.

Our solution streamlines the compliance process. With minimal training required for live video KYC call verification, businesses can collect necessary documentation and meet local regulations effortlessly. Video calls are recorded and stored with key interaction time stamps for easy playback for a full audit trail. This approach not only reduces the risk of non-compliance but also empowers organizations to operate confidently within established frameworks.

Biometrics Beyond Boundaries: Accuracy and Inclusivity

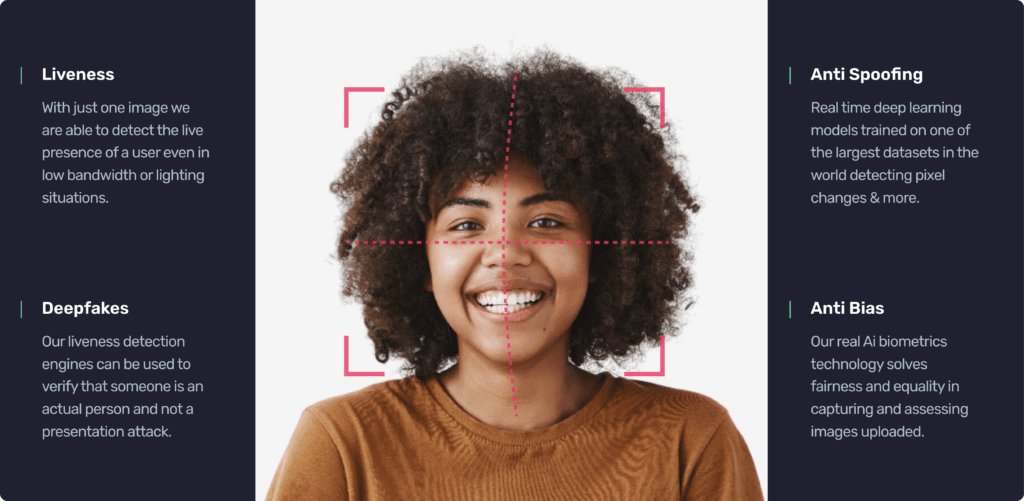

Legacy technology stacks in facial recognition technology have undermined the accuracy of identity verification. The repercussions are profound, eroding trust and perpetuating racial biases.

Enter our proprietary biometrics engine – a cutting-edge innovation that ensures accurate and unbiased verification. By incorporating advanced biometric re-authentication, we eliminate the risk of errors and biases, creating a secure and inclusive verification process. This not only restores confidence in the verification process but also contributes to a more equitable customer experience.

Bridging Tradition and Innovation: Embracing Digital Transformation

In certain regions, traditional face-to-face transactions have been the norm due to local regulations. This has hindered the adoption of digital solutions, leaving customers and businesses grappling with inefficiencies. In countries like Germany, where regulations traditionally required face-to-face banking transactions, the advent of Video KYC has reshaped their banking norms. While regulations now permit the use of Video KYC, the existing solutions have encountered a series of challenges that we’ve addressed throughout this blog.

Our Seamless Video KYC Verification software bridges this gap by offering a solution that is performed in real-time and without interruption by taking required technical and organisational measures. This empowers organizations to comply with local norms while providing customers the convenience of digital banking. It’s a testament to our commitment to harmonizing tradition and innovation in the pursuit of customer-centric solutions.

In conclusion, the challenges inherent in Video KYC verification are significant, but not insurmountable. Our forward-thinking approach, marked by efficient video onboarding, streamlined compliance, proprietary biometric authentication, and the integration of tradition with innovation, offers a comprehensive solution to transform customer onboarding experiences.

As industries evolve and customer expectations continue to rise, embracing technologies like ours is essential for businesses aiming to remain competitive and relevant. Are you ready to revolutionize your onboarding process?

Contact us today to embark on a journey towards seamless and secure customer interactions. Together, we can overcome challenges and unlock the true potential of Video KYC verification.