A Comprehensive Identity Verification Comparison

Table of Contents

- Introduction

- Quick Overview of Veriff

- Veriff Pricing

- Is Veriff Worth It?

- What Users Say About Veriff

- Where Veriff Falls Short

- Amani’s All-in-One Identity Platform

- Get Started with Amani

1. Introduction

Veriff leverages advanced technology and a global reach to provide identity verification services across various industries. However, as with any platform, it’s essential to ask—does Veriff offer the best value for your business needs?

To help you make an informed decision, we’ve examined Veriff’s main benefits and shortcomings. We’ve also gathered insights from Veriff users to hear what they have to say about the platform.

This guide compiles our findings, reflecting current user experiences with Veriff and presenting another option worth considering.

2. Quick Overview of Veriff

Veriff is a well-established player in the identity verification space, offering a comprehensive set of tools to help businesses confirm identities, comply with regulations, and prevent fraud. The platform is particularly noted for its speed and ease of use, making it a popular choice for businesses operating internationally.

Key Features:

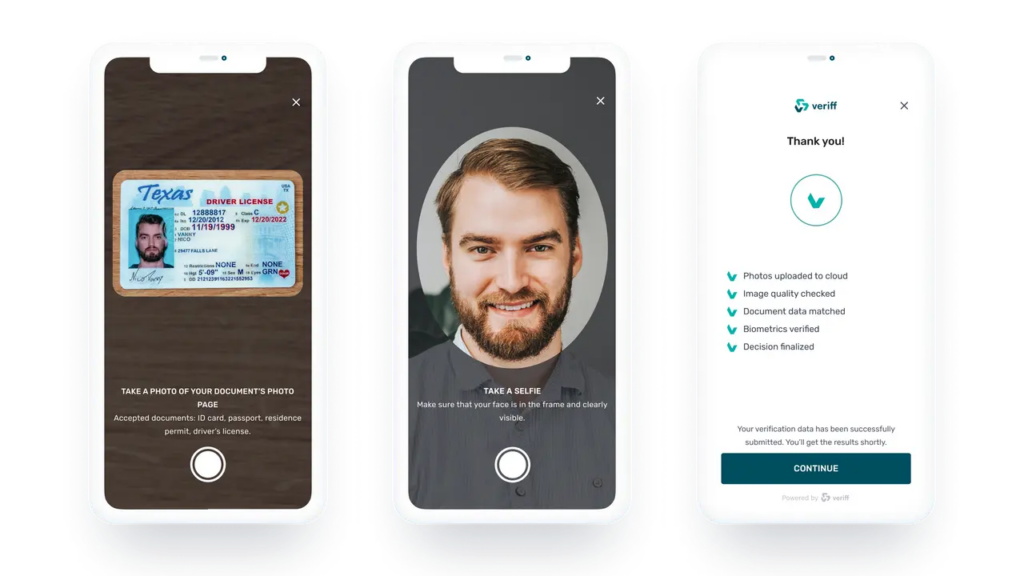

- Comprehensive Document and Identity Verification: Veriff provides document verification services, ensuring the authenticity of various forms of identification across different regions.

- Proof of Address Verification: A specialized tool for verifying user addresses, critical for compliance in many industries.

- Biometric Authentication: Veriff offers secure and seamless biometric authentication, including facial recognition, to verify identities in real-time.

- Database Verification Checks: Ensures user identities against existing database entries for faster and more accurate verifications.

- Proof of Address Verification: Verifies residential addresses through official documentation.

- AML Screening and Monitoring: The platform includes anti-money laundering (AML) checks, helping businesses meet regulatory requirements and reduce the risk of fraud.

- Age Validation and Fraud Protection: Specialized checks like age validation to prevent underage fraud, especially useful for industries like online gamings used by companies in various sectors, including finance, e-commerce, and gaming, providing them with the ability to meet global compliance standards and reduce fraud.

3. Veriff Pricing

Veriff offers both self-serve and enterprise pricing models, catering to businesses of various sizes and needs.

Veriff offers flexible pricing structures that cater to businesses of different sizes and verification needs. Their pricing model is designed around tiered service levels, providing options for businesses ranging from small-scale to enterprise operations.

Self-Serve Pricing:

Veriff provides several pricing tiers based on the level of verification features required:

- Essential Tier: Designed for businesses with fundamental verification needs, this plan includes basic document and face matching but limits the number of fields extracted from identity documents.

- Plus Tier: Offers enhanced fraud prevention tools and extracts data from a greater number of fields but still has a cap on the amount of data extracted per document.

- Premium Tier: Tailored for businesses with high-volume or advanced compliance requirements, this plan includes AML compliance features and 24/7 support, with a higher limit on field extraction.

Important Consideration: Veriff’s self-serve pricing plans limit the number of fields extracted from identity documents, with the maximum number of fields varying depending on the plan. For businesses requiring additional data extraction beyond the included fields, Veriff charges an additional $0.30 per verification. This can significantly impact costs for businesses with more comprehensive data extraction needs, especially at higher verification volumes.

Enterprise Pricing:

- Customizable Packages:

- Pricing: Custom pricing based on the volume of verifications and specific business needs.

- Features: Enterprise packages offer maximum flexibility, including tailored verification workflows, priority support, and dedicated account management.

- Note: Similar to self-serve plans, additional costs apply for extracting more data fields beyond the included limits.

While Veriff provides transparent pricing for its self-serve plans, the enterprise pricing can vary significantly depending on the specific requirements of the business, making it essential for companies to engage with Veriff’s sales team to obtain an accurate quote.

4. Is Veriff Worth It?

What Users Say About Veriff

Veriff generally receives positive feedback from its users, with ratings of 4.5/5 on G2. Users often highlight the platform’s speed, ease of use, and international operability as key strengths.

- Speed and Ease of Use: Users appreciate Veriff for its fast verification process and user-friendly interface, which make it efficient for international operations.

- Support and Innovation: Veriff’s customer support is described as helpful and proactive, with a focus on continually improving services and innovating new solutions.

- Security and Compliance: The platform is praised for its robust security features, fraud prevention capabilities, and compliance with international standards.

Despite these positives, some users have raised concerns about the level of personal information required, viewing it as potentially invasive. Others have highlighted the platform’s strong security features, particularly its real-time document and face verification capabilities, which are crucial for fraud prevention and compliance.

Where Veriff Falls Short

However, Veriff is not without its drawbacks. One significant issue is the potential for false positives and negatives, where users are incorrectly verified or rejected. This can lead to serious security risks, including data breaches and identity fraud. Once a false positive occurs, a bad actor could potentially use the verified identity across multiple platforms, leading to account takeovers—a risk heightened by phishing attacks.

Additionally, the cost of Veriff’s services has been mentioned as a downside, particularly for businesses with tight budgets. The platform’s dependency on stable internet connectivity can also be a limitation, especially in regions with less reliable infrastructure.

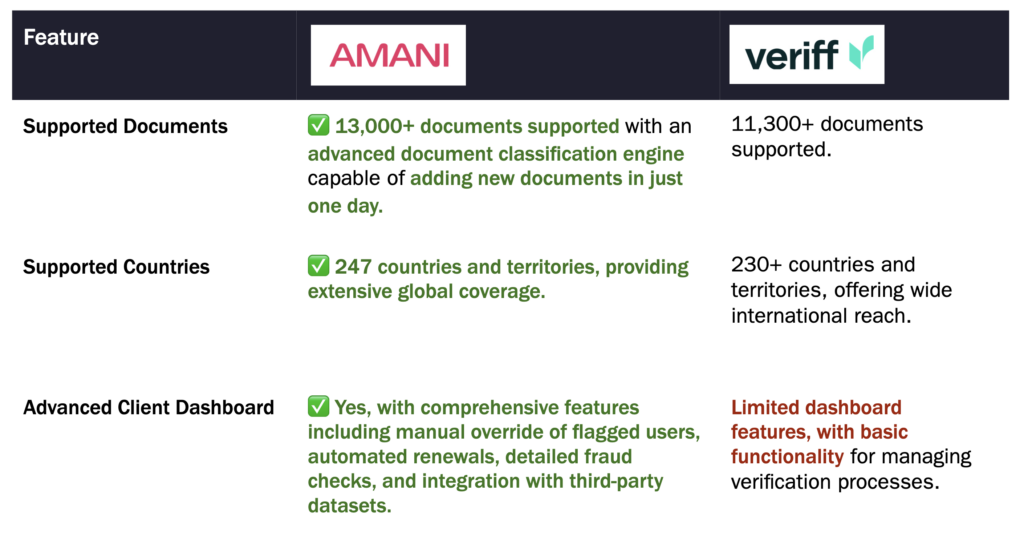

Veriff’s self-serve pricing plans extract data from only 5 to 10 fields on an identity document, depending on the plan. If you need more comprehensive data extraction, Veriff charges an additional $0.30 per document. This can quickly add up for businesses with higher verification needs. In contrast, Amani’s self-serve pricing plans provide 116+ validation checks per ID and utilizes proprietary biometric technology that extracts 468 facial points to generate a 3D face model, matched to the NFC data and ID photographs, all without additional charges. This makes Amani a more cost-effective and thorough solution for identity verification.

5. Amani’s All-in-One Identity Platform

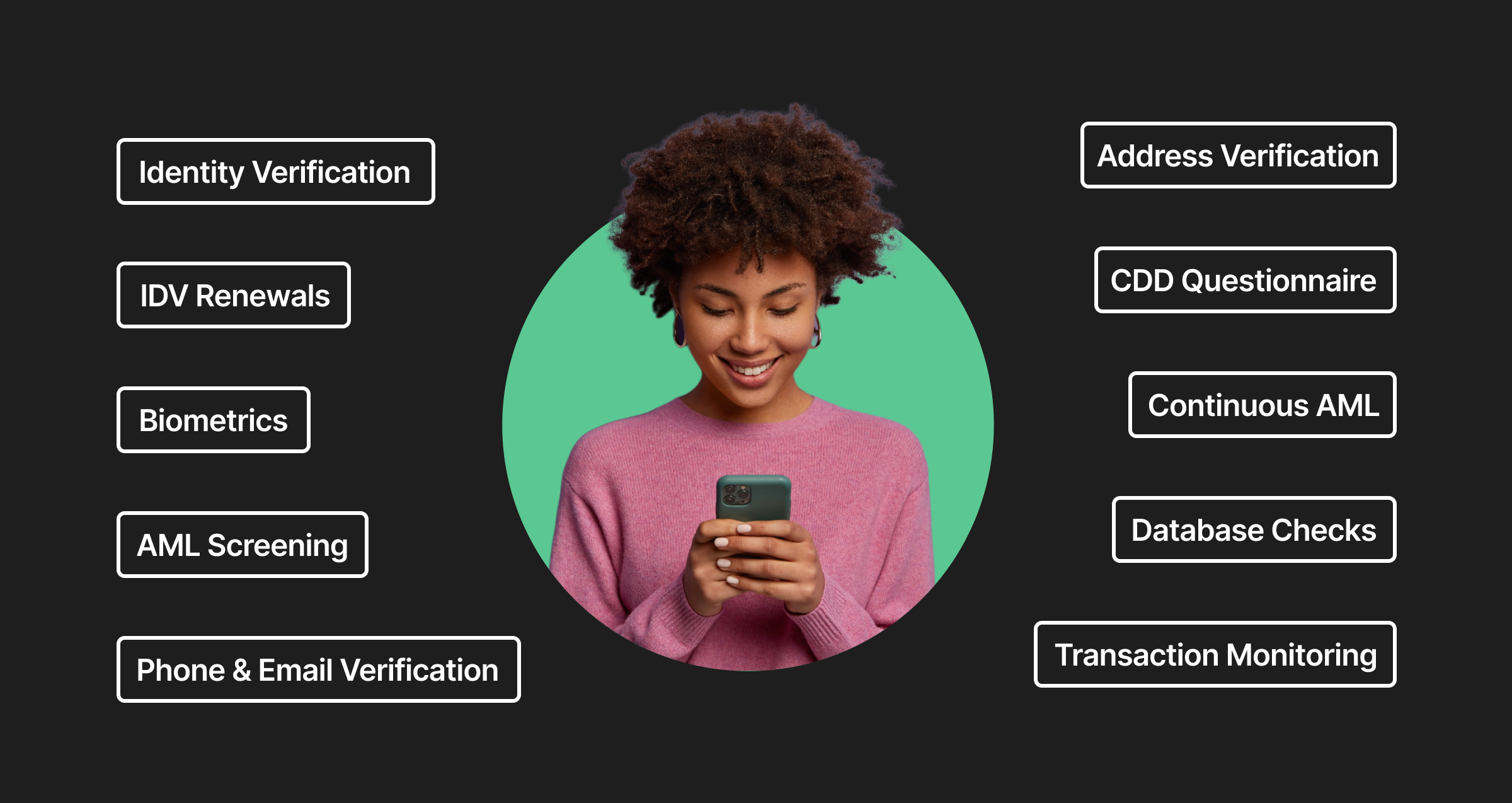

While Veriff offers a range of powerful tools, Amani provides an alternative that combines all these features into a single, streamlined platform—at a more competitive price. Amani’s all-in-one identity platform includes everything from identity and biometric verification to AML screening, transaction monitoring, and more.

Amani’s microservices approach, allows businesses to design the workflow of their onboarding journey according to their specific needs and risk appetite. This flexibility ensures that each business can tailor its onboarding processes to perfectly match its security requirements, making Amani not just a powerful tool but also a highly adaptable one.

Why choose Amani?

Pricing Model:

Amani offers flexible pricing tailored to the needs of different business sizes:

Enterprise Packages: For larger organizations, Amani offers annual packages that range from 10,000 to 1 million verifications per annum. These packages are customized to meet the specific needs and scale of each business. For a tailored quote, reach out to us.

With Amani, businesses can consolidate all their identity verification needs into one platform, saving time, reducing costs, and enhancing security—all while enjoying the freedom to customize their processes to fit their unique risk management strategies.

Attention, SMBs. You get 3 months free to test the features first-hand and see everything Amani can do for you without the upfront financial commitment.

💡Keep reading: For pricing information on platforms similar to Veriff, check out the following pages:

- Jumio vs Amani

- Sumsub vs Amani

- Persona vs Amani

- Shufti Pro vs Amani

- Onfido vs Amani

- Faceki vs Amani

- Uqudo vs Amani

If you want more info on Amani’s features and use cases, you can reach out to us here and we will make sure to provide all the details you need.