Amani vs. Onfido

Table of Contents

- Introduction

- Quick Overview of Onfido

- Onfido Pricing

- Is Onfido Worth It?

- What Users Say About Onfido

- Where Onfido Falls Short

- Amani’s All-in-One Identity Platform

- Why Choose Amani?

- Pricing Model

- Get Started with Amani

1. Introduction

Onfido leverages many exciting technologies and features to automate identity verification and onboarding processes. Still, the platform isn’t failproof, which begs an important question—is it worth the investment?

To help you make an informed decision, we’ve examined Onfido’s main benefits and shortcomings. We’ve also gathered insights from Onfido users to hear what they have to say about the platform.

This guide compiles our findings, reflecting current user experiences with Onfido and presenting another option worth considering.

2. Quick Overview of Onfido

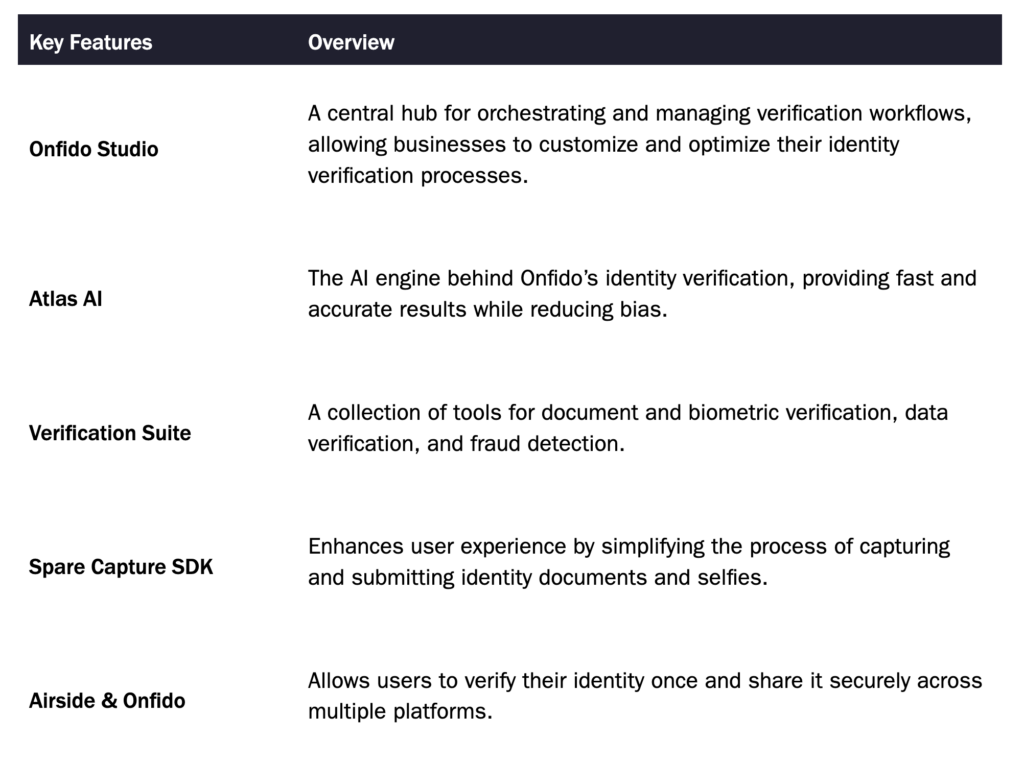

Onfido is a prominent name in the identity verification industry, known for its comprehensive Verification Suite, which includes document verification, biometric verification, and fraud detection tools. The platform is designed to help businesses across various industries streamline their onboarding processes, meet compliance requirements, and prevent fraud.

3. Onfido Pricing

Onfido offers a tiered pricing model, which varies depending on the services and volume of verifications required. Typically, businesses can expect to pay more for additional verification checks, such as biometric analysis or fraud detection. Pricing details are often customized based on the specific needs of the business, with higher costs for more comprehensive packages.

However, there isn’t much detailed information available online about Onfido’s pricing structure. After further investigation, we found a review on TrustRadius that sheds some light on the challenges users face with Onfido’s pricing model. According to the review, one of the downsides of Onfido is that the pricing model is complex and relies heavily on accurate predictions of platform and user growth to secure the best price-per-check. This can be particularly challenging in a startup environment, where growth can be unpredictable.

In addition to pricing complexity, there have been notable concerns related to security. In April 2024, Onfido was acquired by Entrust, a company that experienced a data breach in 2023, where customer data was stolen during a cyberattack. Furthermore, in a separate incident, Onfido itself had a security lapse, exposing biometric data and personal information of potentially millions of users. These incidents have raised concerns about the overall security and reliability of the platform.

While Onfido is a robust solution, the complexity of its pricing model, coupled with these security concerns, may be significant considerations for businesses, especially those in their early stages or those that require flexibility and stringent data security measures.

4. Is Onfido Worth It?

What Users Say About Onfido

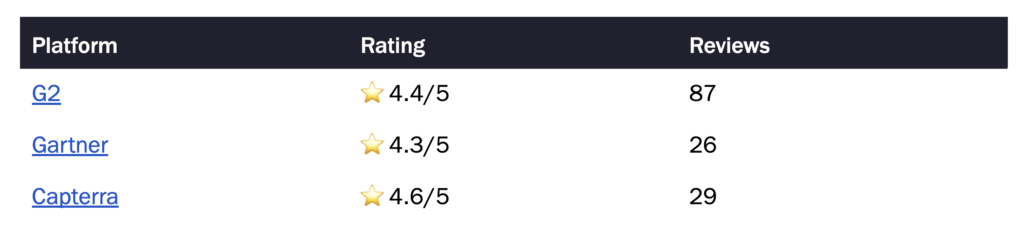

Users are typically happy with Onfido’s performance, as evidenced by the platform’s high ratings on many reputable review sites, such as:

Some of the main reasons users appreciate Onfido include:

- Functionality: Users often highlight how easy Onfido is to use, with a straightforward interface that simplifies identity verification processes.

- High Document Coverage: Onfido supports a broad range of documents from various countries, which is crucial for businesses operating globally.

- Responsive Customer Support: Many users commend Onfido’s customer support team for being responsive and helpful when issues arise.

That being said, not everyone has had positive experiences with the platform.

Where Onfido Falls Short

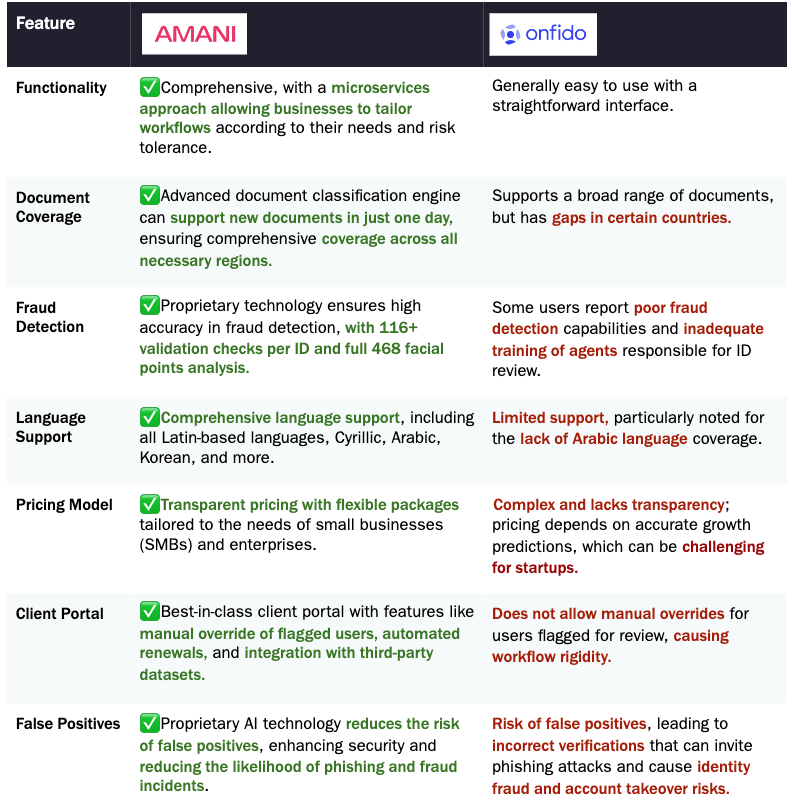

While Onfido provides robust identity verification solutions, some users have expressed concerns about certain aspects of the platform. For instance, one user on G2 mentioned dissatisfaction with Onfido’s fraud detection capabilities, describing them as generally poor. This user also noted that the agents responsible for reviewing IDs appear to lack adequate training, which could compromise the accuracy and reliability of the verification process.

Another significant criticism is the platform’s potential for false positives, where users are incorrectly verified. This issue is particularly concerning because it means that individuals who should not have passed the verification process could be falsely cleared, exposing businesses to risks such as data breaches, fraud, and compliance failures. Moreover, once a bad actor has obtained a verified identity, they can use it across multiple platforms—a capability supported by Onfido’s Airside partnership—which presents a significant risk for identity fraud and account takeovers. This risk is exacerbated by the possibility of phishing attacks, where verified identities can be exploited for malicious purposes. Additionally, integration complexities have been noted, which can lead to challenges in effectively embedding Onfido into existing systems.

The pricing model is another area where Onfido has faced criticism. Users have described it as complex and lacking transparency, making it difficult for businesses, especially startups, to predict costs accurately. Additionally, some users on Gartner have expressed concerns about the unclear pricing related to fraud investigations and have criticized the platform’s “one size fits all” approach, where solutions to problems often come with an upsell rather than a tailored fix.

A particular issue that affects businesses with specific language needs is Onfido’s limited language coverage. For example, one user highlighted the lack of Arabic language support as a significant drawback, especially for companies operating in regions where this language is prevalent.

Moreover, when a client is flagged for review in Onfido, the system does not allow manual overrides to approve the user, which can slow down the verification process. This rigidity in the workflow has been a point of frustration for some users. In contrast, Amani offers flexibility through its client portal, giving customers the power to manually override and approve users flagged for review, ensuring that businesses can maintain control over their verification processes.

Finally, Onfido’s document coverage, while broad, still has gaps according to some users. There are countries where the number of accepted documents is limited, which can be a significant barrier for businesses needing comprehensive coverage. Amani addresses this issue with its advanced document classification engine, capable of supporting new documents in just one day, ensuring that businesses have the document coverage they need.

5. Amani’s All-in-One Identity Platform

While Onfido offers a range of powerful tools, Amani provides an alternative that combines all these features into a single, streamlined platform—at a more competitive price. Amani’s all-in-one identity platform includes everything from identity and biometric verification to AML screening, transaction monitoring, and more.

Amani’s microservices approach, allows businesses to design the workflow of their onboarding journey according to their specific needs and risk appetite. This flexibility ensures that each business can tailor its onboarding processes to perfectly match its security requirements, making Amani not just a powerful tool but also a highly adaptable one.

Why choose Amani?

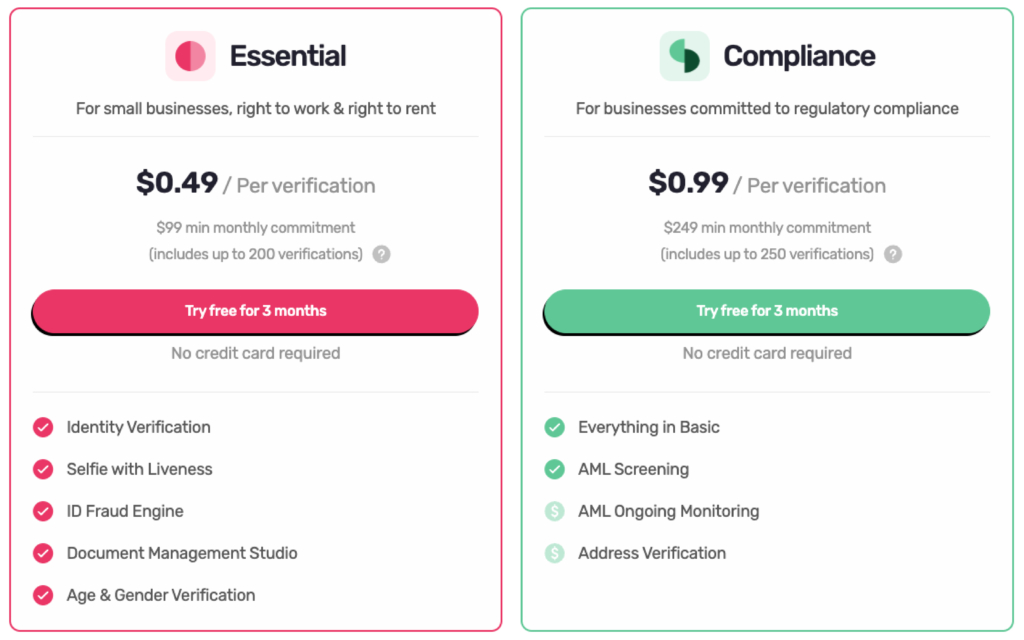

Enterprise Packages: For larger organizations, Amani offers annual packages that range from 10,000 to 1 million verifications per annum. These packages are customized to meet the specific needs and scale of each business. For a tailored quote, reach out to us.

With Amani, businesses can consolidate all their identity verification needs into one platform, saving time, reducing costs, and enhancing security—all while enjoying the freedom to customize their processes to fit their unique risk management strategies.

Attention, SMBs. You get a 14-day free trial to test the features first-hand and see everything Amani can do for you.

💡Keep reading: For pricing information on platforms similar to Onfido, check out the following pages:

- Veriff vs Amani

- Sumsub vs Amani

- Persona vs Amani

- Shufti Pro vs Amani

- Jumio vs Amani

- Faceki vs Amani

- Uqudo vs Amani

If you want more info on Amani’s features and use cases, you can reach out to us here and we will make sure to provide all the details you need.